|

If you don't already use a mobile payment app, chances are, you've at least heard of them. You may have had a friend trying to pay you back for lunch at Zingerman's ask, "Do you have Venmo?" Or, perhaps you've seen the Apple Pay logo on myriad credit card machines in stores. More than ever, these payment systems are growing and becoming mainstream. Let's explore what exactly mobile payment apps are, and should you be using them?

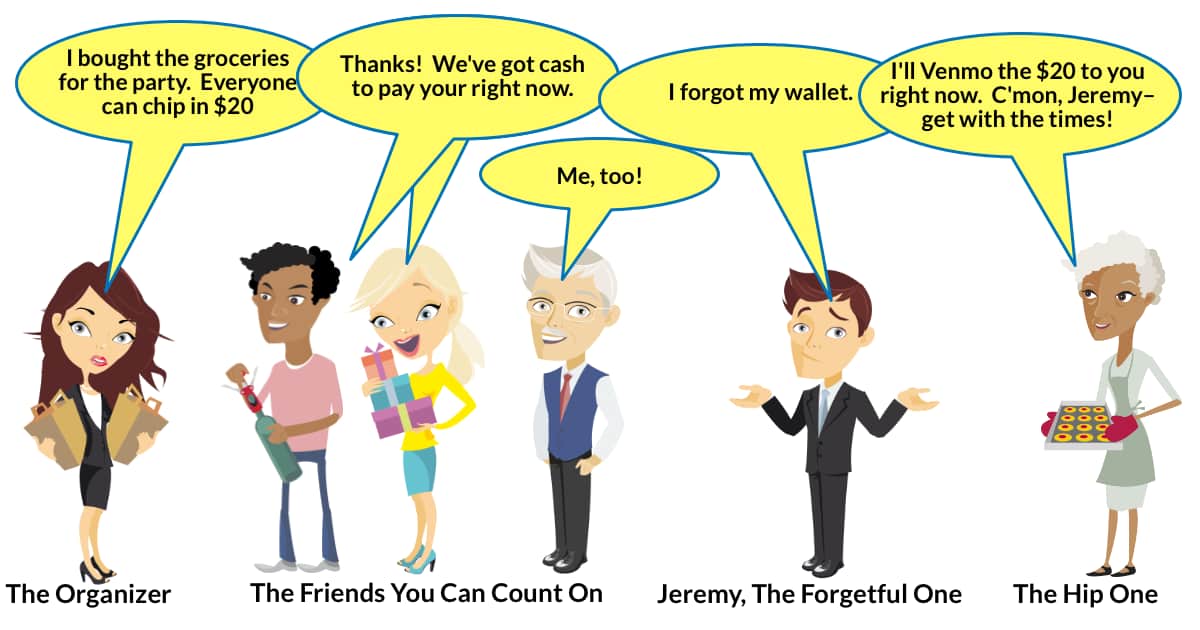

First, what is a mobile payment app? As the name suggests, it's an application that you can use from your smartphone to pay for things. The various types basically fall into two categories. 1. Apps to pay for goods and services directly to businesses 2. Apps to send money directly to another person (known as person-to-person or P2P) Examples of payment apps in the first category include Apple Pay, Google Pay, Samsung Pay, and PayPal. Some of them come pre-installed on your smartphone, and some you have to download. To use one of the apps, you need to enter and store your credit card information. This is done securely, as only you can access it with your passcode, Touch ID, or facial recognition. When you go to pay for something at the store, your authorization sends your payment information as an anonymized token (an encrypted version of your credit card number). Your actual number is not sent, so paying with the app is considered safer than physically handing over your card. Additionally, these transmissions comply with the same encryption security standards as regular card payments. And, most banks these days have a no-liability policy to protect you against fraud, so you can use the app with peace of mind. All of the above mentioned apps also fall into the second category: Person-to-Person (P2P) transactions. With each one, you can securely link your bank account or bank debit card in order to pay a friend directly. Two additional apps in this division are Zelle and Venmo. While you can't use the latter two in a store at the credit card machine, they are secure ways to pay individuals. You'll find that many banks have incorporated Zelle into their own mobile apps. Venmo is so popular, in fact, that we've seen its verbification: "Can I Venmo you that?" Zelle transactions go directly from your bank account to your friend's bank account. (Same with Google Pay.) With Venmo and the other apps, when someone pays you, the money goes into a holding area. You then must transfer it to your bank account, which takes 1-3 days. (Note: Venmo will allow you to receive funds directly to your bank account for a small fee.) Think of using P2P apps for paying individuals to be just like handing over cash to someone, so be careful. When the transaction is complete, you can't get your money back if you change your mind or sent it to the wrong person (unless your payee has a conscience). It's important, therefore, that you only use P2P apps with someone you know. Employed smartly, though, mobile payment apps are a quick, convenient, and safe way to make transactions. Before setting up the first one on my phone a few years ago, I called my bank to get its opinion. The response I received was reassuring, and I've been using 4 of these apps ever since. Mobile payment apps are growing in number and are here to stay for the time being. According to a NerdWallet survey in 2020, 79% of Americans reported using mobile payment apps. So go ahead and use them–use them wisely, and use them confidently.

0 Comments

Leave a Reply. |

Proudly powered by Weebly